New Transaction

A new transaction begins with filling the customer details and the payment details in the respective pages. A new transaction is accomplished/confirmed once the successful transaction message is received with transaction Id.

Table of Contents

What to do:

|

Feature

|

Description

|

|

Active Merchant

|

Select the merchant in the drop-down to view the associated merchant transaction

|

|

Language

|

Select the preferred language in the drop-down

|

|

|

Select to view dashboard in full screen

|

|

Select to minimize the menu bar

|

|

|

Search

|

Enter the entity to display the transaction data based on the search

|

|

Customer Details

|

Enter the customer details

|

|

Payment Details

|

Enter the payment details

|

|

Confirmation

|

Confirm message for a successful transaction

|

|

Previous

|

View the previous page

|

|

Next

|

View the next page

|

|

Proceed with Payments

|

Begin the payment process

|

The steps to create new transaction are:

Customer Details

The first step to create new transaction is to fill the customer details in the customer details screen.

|

Field

|

Description

|

|

Merchant Code

|

Merchant code is auto-populated when you select merchant in Active Merchant drop-down

|

|

Current Customers

|

Select the customer in the drop-down.

The fields First Name, Last Name, Company Name, Customer Email Address, Billing Address 1, Billing Address 2, Billing City, Billing State/Province, Billing Postal Code, Customer Phone Number, Customer Code are auto-populated.

|

|

Invoice Number

|

Enter the invoice number

|

|

Product Description

|

Enter the product description

|

Payment Details

In the payment details screen, you can choose the appropriate payment mode per your requirement.

|

Field

|

Description

|

|

Frequency

|

Select the frequency in the drop-down.

The valid values are:

|

Back-To-Top

Frequency: One-Time Transaction

The frequency of transaction occurred only once.

|

Field

|

Description

|

|

Frequency

|

Select the option One-Time Transaction in the drop-down

|

|

Transaction Type

|

Select the transaction type in the drop-down.

The valid values are:

|

|

Amount

|

Enter the amount

|

|

Current Payment Methods

|

Select the current payment method in the drop-down.

The valid values are:

Note: The drop-down populates the card number details already used for transaction. For example: Card - Visa - *****1111

|

|

Sales Tax

|

Enter the sales tax.

Note: Sales tax is applicable only if the transaction is subject to taxation. Enter an amount in decimal format.

|

|

Memo

|

Enter the additional details of the transaction, if any

|

Frequency: Future One-Time Transaction

The frequency of transaction will occur only once in future on a specific date.

|

Field

|

Description

|

|

Frequency

|

Select the option Future One-Time Transaction in the drop-down

|

|

Transaction Date

|

Click the calendar widget to select the specific date for a future one-time transaction

|

|

Transaction Type

|

Select the transaction type in the drop-down.

The valid values are:

|

|

Amount

|

Enter the amount |

|

Current Payment Methods

|

Select the current payment method in the drop-down. The valid values are:

Note: The drop-down populates the card number details already used for transaction. For example: Card - Visa - *****1111

|

|

Sales Tax

|

Enter the sales tax.

Note: Sales tax is applicable only if the transaction is subject to taxation. Enter an amount in decimal format.

|

|

Memo

|

Enter the additional details of the transaction, if any

|

Frequency: Recurring

The frequency of transaction occurred at pre-determined intervals.

|

Field

|

Description

|

|

Frequency

|

Select the option Recurring in the drop-down

|

|

Start Date

|

Click the calendar widget to select the start date of a transaction

|

|

Schedule

|

Select the schedule of a transaction in the drop-down.The valid values are:

|

|

Transaction Type

|

Select the transaction type in the drop-down.The valid values are:

|

|

Amount

|

Enter the amount

|

|

Current Payment Methods

|

Select the current payment method in the drop-down. The valid values are:

Note: The drop-down populates the card number details already used for transaction. For example: Card - Visa - *****1111

|

|

Sales Tax

|

Enter the sales tax.

Note: Sales tax is applicable only if the transaction is subject to taxation. Enter an amount in decimal format.

|

|

Memo

|

Enter the additional details of the transaction, if any

|

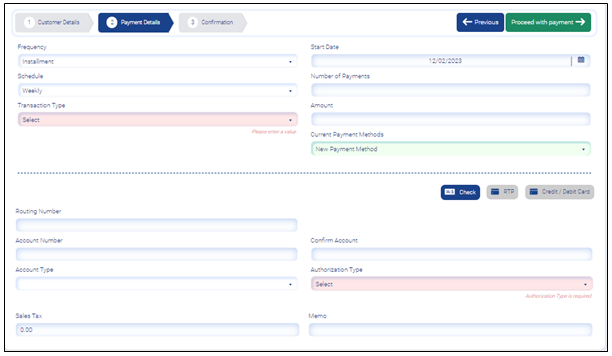

Frequency: Installment

The frequency of transaction occurred in multiple segments, over a period of time agreed between the cardholder and the merchant.

|

Field

|

Description

|

|

Frequency

|

Select the option Installments in the drop-down

|

|

Start Date

|

Click the calendar widget to select the start date of a transaction |

|

Schedule

|

Select the schedule of a transaction in the drop-down.The valid values are:

|

|

Number of Payments

|

Enter the number of payments to complete the installment amount

|

|

Transaction Type

|

Select the transaction type in the drop-down.The valid values are:

|

|

Amount

|

Enter the amount

|

|

Current Payment Methods

|

Select the current payment method in the drop-down. The valid values are:

|

|

Sales Tax

|

Enter the sales tax.

Note: Sales tax is applicable only if the transaction is subject to taxation. Enter an amount in decimal format.

|

|

Memo

|

Enter the additional details of the transaction, if any

|

Back-To-Top

Current Payment Method

You can choose the payment method in the Current Payment Methods drop-down.

Current Payment Methods: New Payment Method

Select the new payment method in the current payment methods drop-down.

The three modes of transaction are displayed for new payment method.

- Checks

- RTP

- Credit/Debit Card

| Feature | Click to |

| Check | Enter the ACH account payment details |

| RTP | Enter the Real-time payment details |

| Credit/Debit Card | Enter the Credit/Debit Card payment details |

New Payment Method: Check

Click the Check button to proceed for the payment via Check.

|

Field

|

Description

|

|

Routing Number

|

Enter the 9 digit routing number of your bank

|

|

Account Number

|

Enter the account number

|

|

Confirm Account

|

Re-enter the account number to confirm

|

|

Account Type

|

Select the account type in the drop-down.

The valid values are:

|

|

Authorization Type

|

Select the authorization type in the drop-down.

The valid values are:

|

|

Sales Tax

|

Enter the sales tax.

Note: Sales tax is applicable only if the transaction is subject to taxation. Enter an amount in decimal format.

|

|

Memo

|

Enter the additional details of the transaction, if any

|

New Payment Method: RTP

Click the RTP button to proceed for the payment via RTP.

| Field | Description |

| Routing Number | Enter the 9 digit routing number of your bank |

| Account Number | Enter the account number |

| Confirm Account | Re-enter the account number to confirm |

| Sales Tax | Enter the sales tax |

| Memo | Enter the memo |

New Payment Method: Credit/Debit Card

Click the Credit/Debit Card button to proceed for the payment via Credit/Debit Card.

|

Field

|

Description

|

|

Credit Card Number

|

Enter the credit card number

|

|

Expiration Date

|

Select the expiration date

Month

Select the month in the drop-down.

The valid values are: 01 – 12

Year

Select the year in the drop-down

The valid values are from the current year to next 10 years

For example: Choose the year between 2023 to 2032

|

|

CVC Code

|

Enter the cvc code given in the credit card

|

|

Sales Tax

|

Enter the sales tax.

Note: Sales tax is applicable only if the transaction is subject to taxation. Enter an amount in decimal format.

|

|

Memo

|

Enter the additional details of the transaction, if any

|

Back-To-Top

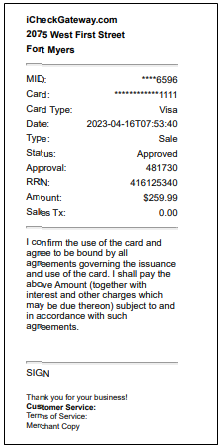

Confirmation

You can find the successful transaction message in the confirmation screen.

|

Feature

|

Click to

|

|

New Transaction

|

Perform another transaction

|

|

Print Receipt

|

Print the receipt of the transaction

|