Transactions

Credit Card Declined

The decline response provided in the Declined Credit Card report is all of the information provided to ICG by the credit card processor.

Most of the time the response just generically says DECLINED without detailed indication as to why. Sometimes, the response can be more descriptive such as INVALID CARD, PICKUP CARD, EXPIRED CARD, or DECLINED CVV2. DECLINED can mean that there wasn't enough available credit on the card, but they can also use it for other reasons as well.

A processor decline indicates that the customer's bank has refused the transaction request. Sometimes you can tell why it was declined by reading the response code, but only the customer's bank can confirm the specific reason. Here are a few of the most common ones:

- Incorrect credit card number or expiration date

- Insufficient funds

- Some banks will reject charges based on location

- Some banks will reject charges based on their own fraud rules

For privacy reasons, the only way to know for sure would be for the cardholder to contact the card issuer and ask why it was declined.

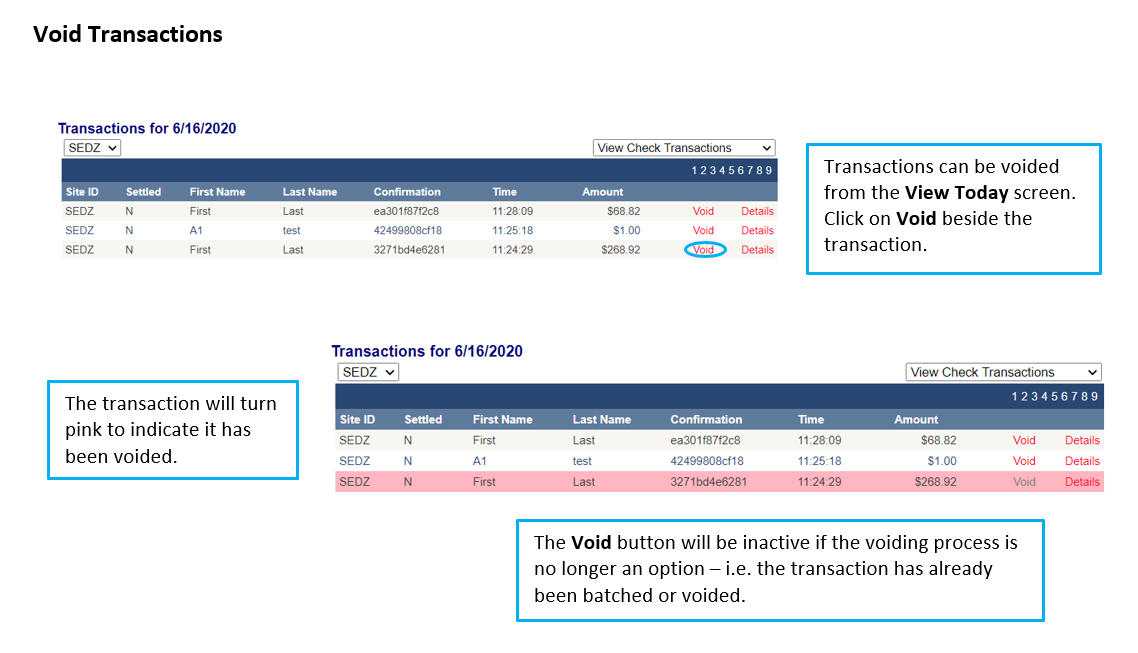

How to Void a Transaction

Payments can only be voided prior to the time they are batched for processing. After payments have been batched, the only option would be to issue a refund if needed.

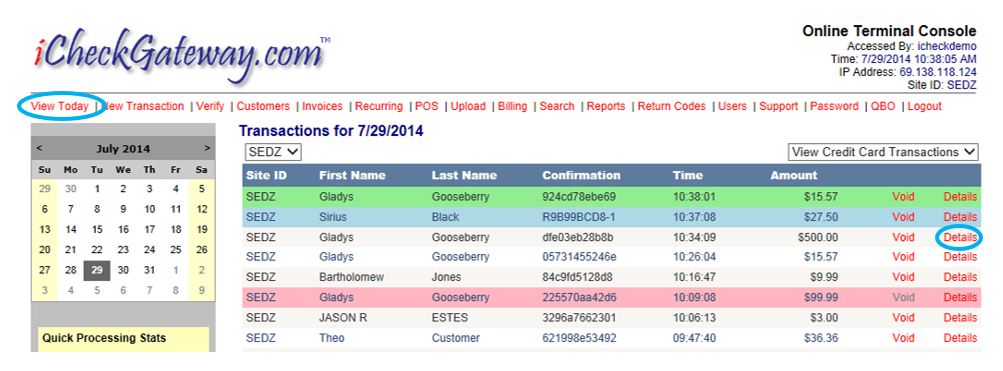

From the View Today screen, you should be able to see the transaction on today's date. You may need to toggle between View Check Transactions and View Credit Card Transactions.

Just click on Void next to the transaction. The transaction will be color-coded pink to let you know it has been voided and will not be included in the batch.

Voided Credit Card Transaction

A void transaction does not appear on the customer's credit card statement, though it might appear in a list of pending transactions when the customer checks their account online.

For credit cards, when you void a transaction, it removes it from your open batch, meaning that it will never be settled; however, it does not remove the initial authorization.

The cardholder will still see a pending charge after the transaction was voided--how long the pending charge appears is up to the bank that issued the credit card.

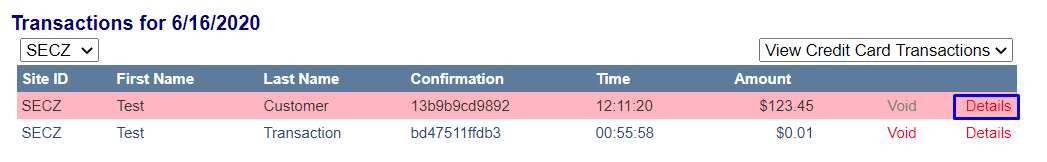

Transaction Voided in Error

The transaction that you voided in error cannot be reinstated. However, you can easily run a new transaction by clicking Details next to the voided transaction on your dashboard.

That will bring up the Transaction Details screen. Click New at the top right of this screen, enter in the payment amount and click Process.

How to Issue a Refund

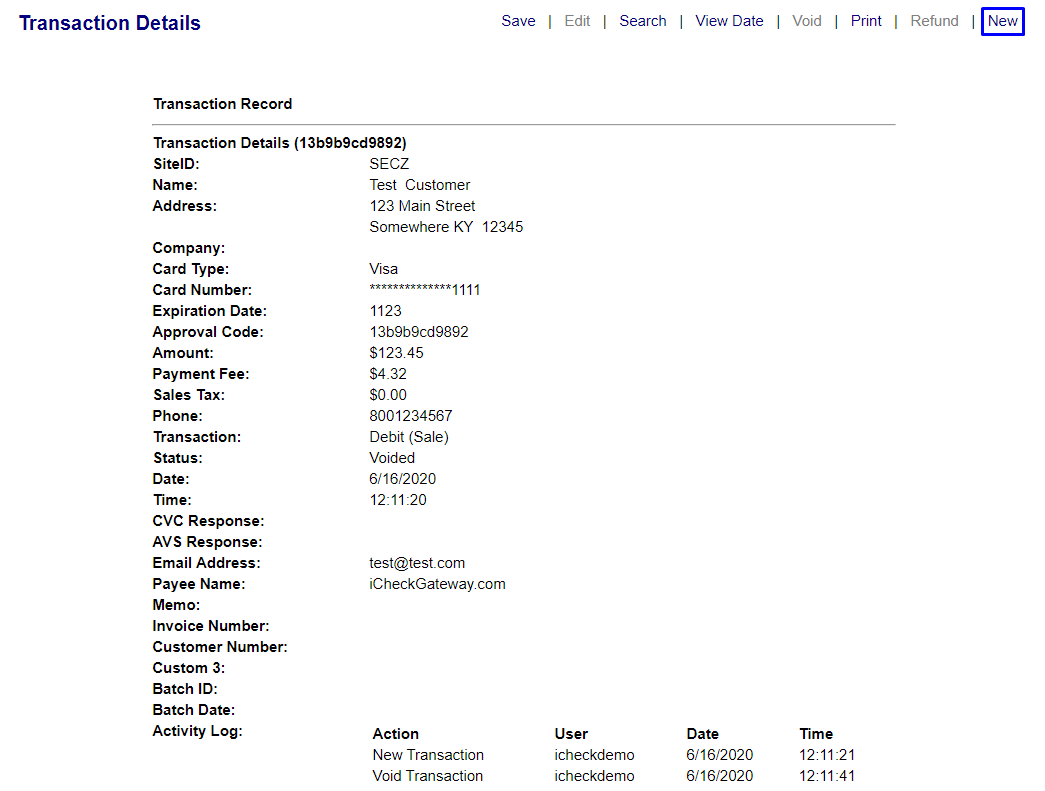

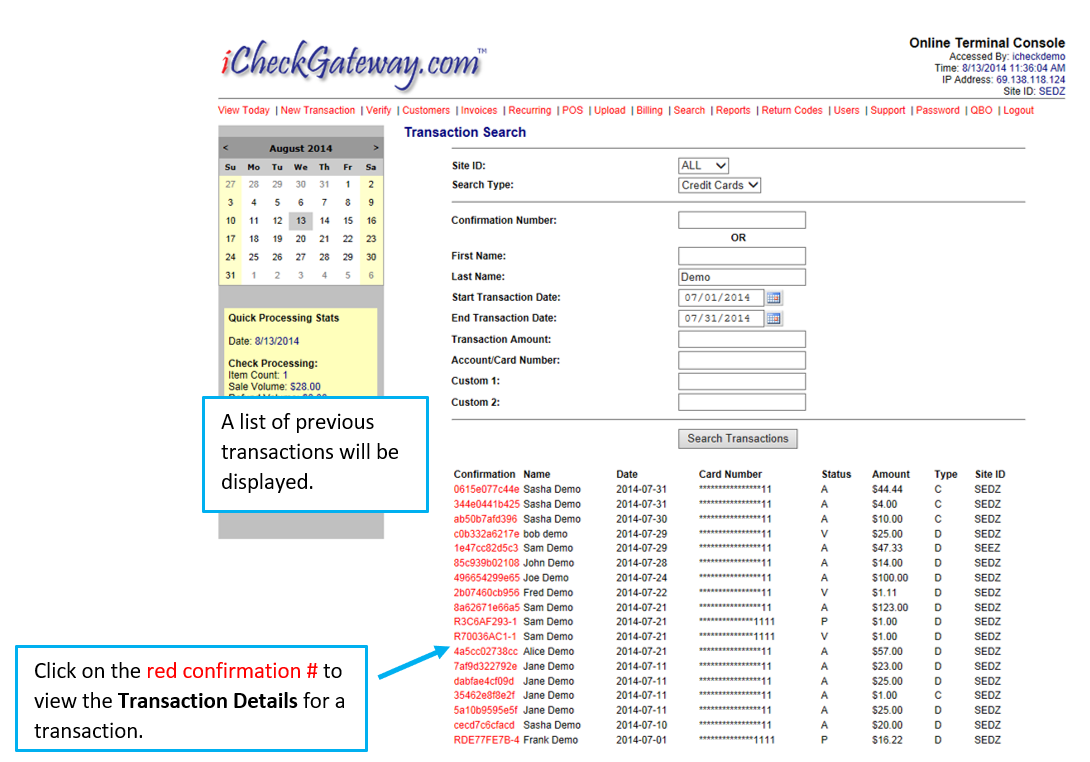

To refund a transaction, pull up the transaction details for the payment you wish to refund. There are several different ways that you can view the transaction details.

If you know the date of the transaction, click on the calendar on the View Today screen to go to that date. Then, click on Details next to the transaction you wish to refund.

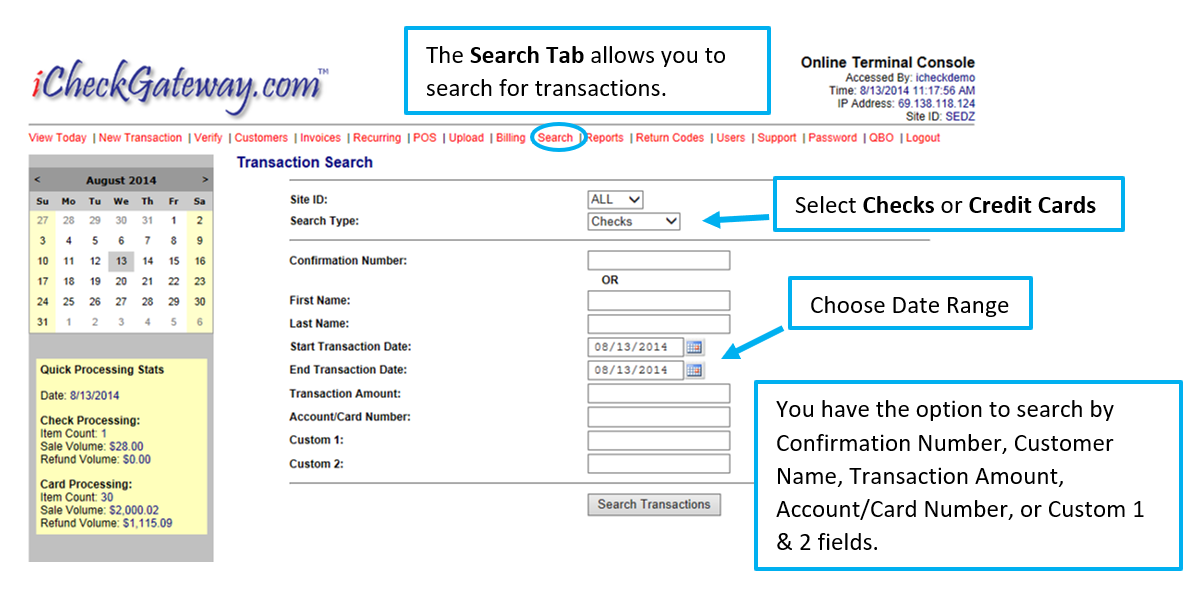

Or you can Search for the transaction by Name, Confirmation #, Account information, etc.

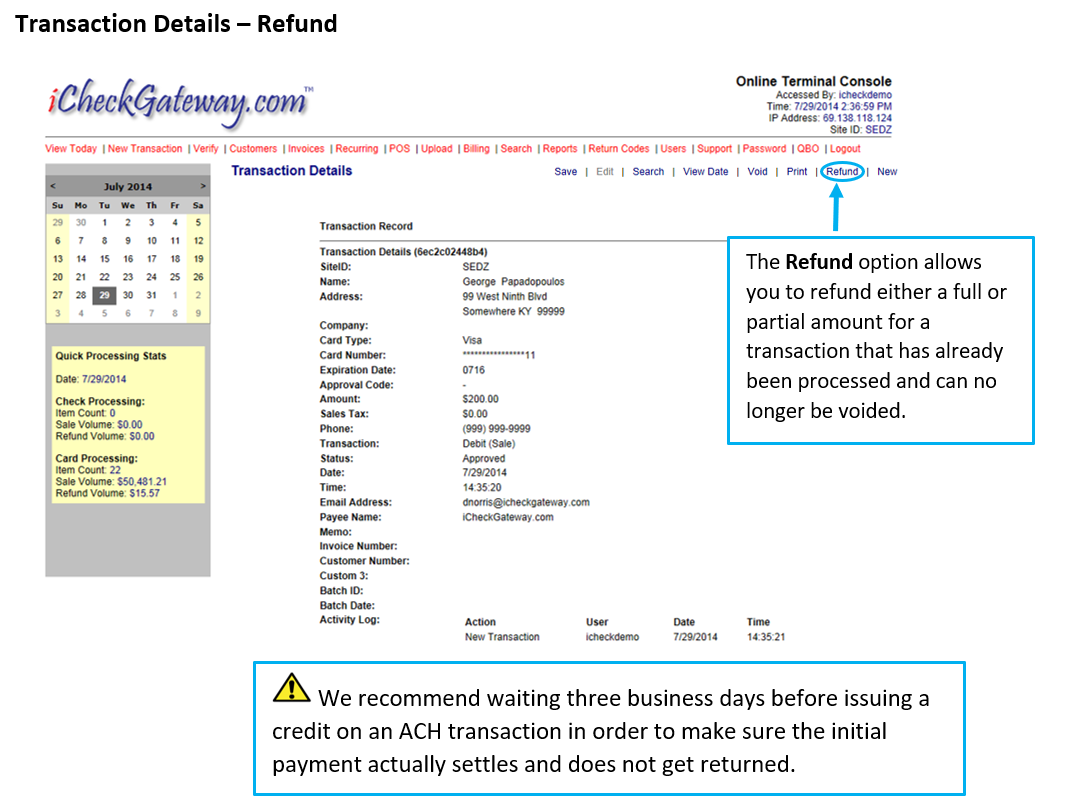

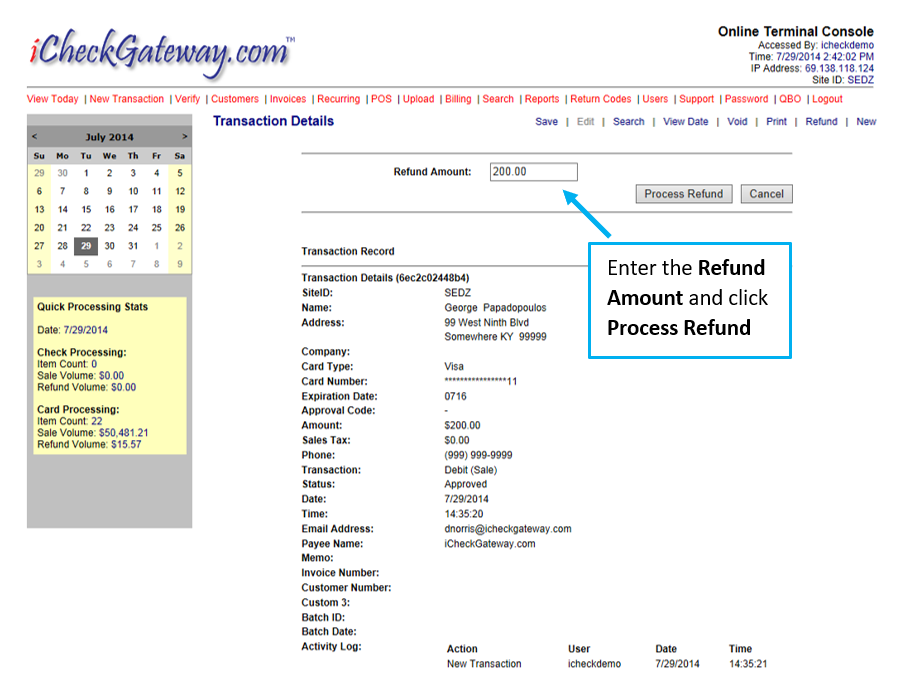

From the Transaction Details screen, click on Refund near the top right.

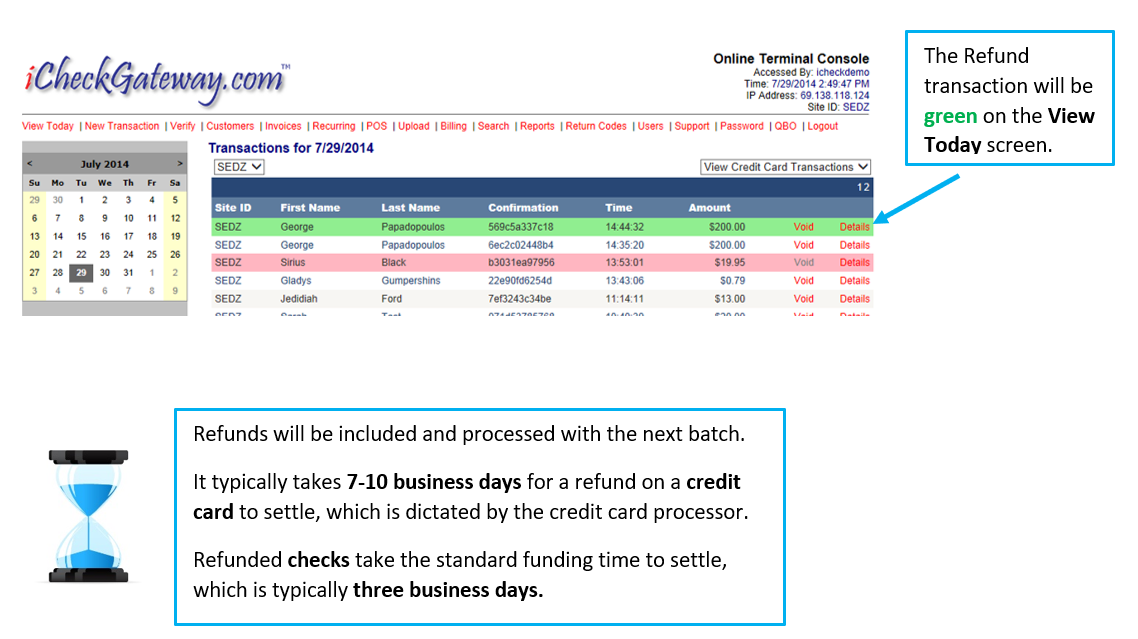

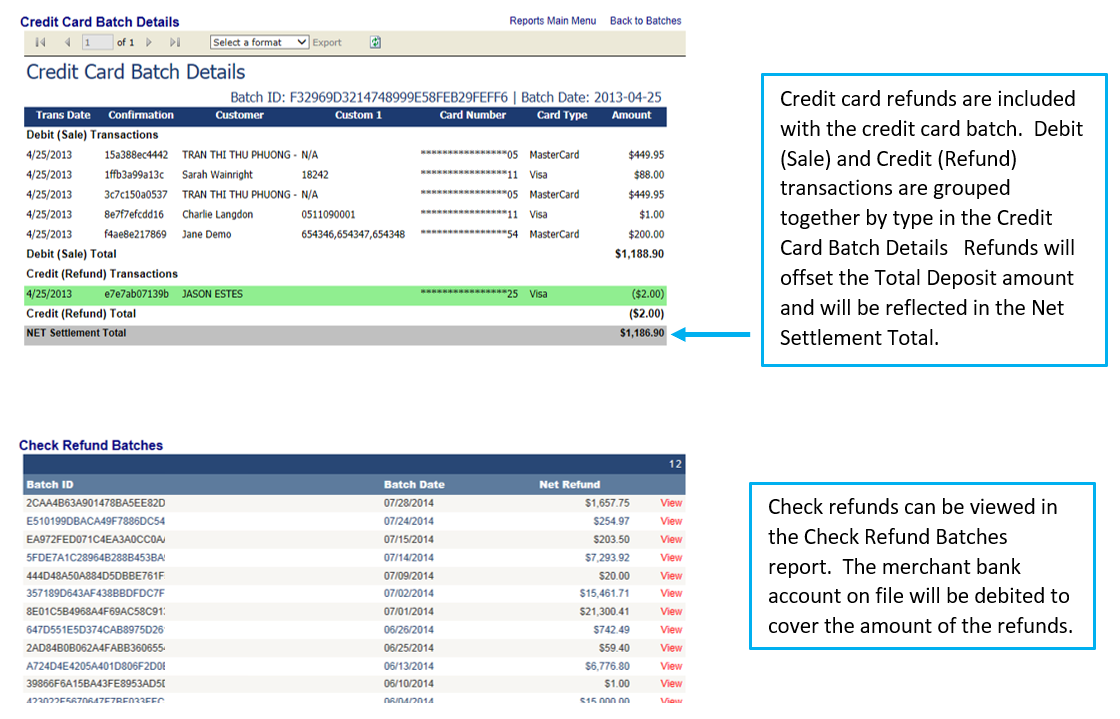

How long does a Credit Card refund take?

It generally takes 7-10 business days for the issuer to settle the refund to the cardholder, but the timeframe can vary as the card issuer legally has 30 days to post the refund back to the cardholder. If the cardholder still does not see the refund after 7-10 business days, they will need to reach out to their card issuer.

How long does an ACH refund take?

The settlement time for an ACH refund is the same as the settlement time for an ACH debit transaction. Whether they are a debit or a credit, there is a 3 business day processing window for all ACH transactions after they have been batched. Checks generally batch around 7:00 pm Eastern.

Note that the 3-day hold does not include weekends or bank holidays. If a check transaction is processed after the batch time, or on a weekend/holiday, that transaction will be included with the batch on the next business day.

Both a debit and a credit (refund) will not settle until the 4th business day to allow the bank time to return a check. We recommend waiting three business days before issuing a credit on an ACH transaction in order to make sure the initial payment actually settles and does not get returned.